We like companies which are designed for long-term profitability. This is the historic, proven model for business success. The great majority of wealth globally was created by founders who grew organically and profitably.

In particular, at the early stages of a company your equity is priced low. We think it’s in your self-interest to raise as little capital as possible, take as much free money as possible, maintain a stingy culture, and build toward Product-Market Fit. Once you’ve done that, your valuation spikes and if you wish you can easily raise growth capital from many VCs.

We have great respect for the founders who consciously decide to forego profitability, raise equity VC, and grow their topline (or at least some metric, like eyeballs) as rapidly as possible. However, that blitzscaling model doesn’t work for most businesses, and is highly risky for all parties.

What is Capital Efficiency?

At the most basic level, capital efficiency is a measure of whether a company uses its cash wisely. We don’t invest in either of the two most common forms of capital-inefficiency:

- A management team who focuses on raising as much VC as possible. This strategy makes sense for companies which fit the blitzscaling model, which typically means they operate in a winner-take-all market with network effects. But raising too much VC can cause serious damage or kill a promising company. Steve Cheney highlights that founders raising more money than they have a clear plan to spend tends to push them to spend unwisely. In a startup, a focus on doing fewer things well is imperative to winning.

- A management team which doesn’t understand how to think analytically about their financing and ownership options. By definition, such a team is not sophisticated enough to build an impactful company.

Formally, you can measure capital efficiency as:

| ROCE (Return on Capital Employed) = | (EBIT (Earnings Before Interest and Tax) / Capital Employed), |

| where: EBIT=Earnings before interest and tax Capital employed=Total assets less current liabilities |

How do you benchmark capital efficiency for SAAS Startups?

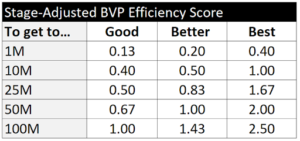

Specifically for SaaS startups, Bessemer Venture Partners suggests a simple rule-of-thumb called the BVP efficiency score: Efficiency Score = Net New ARR / Net Burn. The table below gives you benchmarks for founders with under $30M ARR to think about capital efficiency:

Allen Miller of Oak HC/FT suggests these benchmarks for founders as they grow from $0 to $100M ARR:

On the other hand, David Sacks of Craft Ventures prefers to flip the Efficiency Score and call it the Burn Multiple.

Burn Multiple = Net Burn / Net New ARR

The higher the Burn Multiple, the more the startup is burning to achieve each unit of growth. The lower the Burn Multiple, the more efficient the growth is. For venture-stage startups, these are reasonably good rules of thumb:

For further reading:

What Is Capital Efficiency And Why Is It Important?

The Return of Capital Efficiency

Tiger Global and the Bear Case for Venture

Why Capital Efficiency Matters

Why Capital Efficiency Matters

Permissionless Entrepreneurship

In startups, cash efficiency is the new growth

Capital Efficient Vs. Equity Efficient

The myth of capital efficiency (not exactly on point)

Nauta Capital – Investing In Capital-Efficient B2B Software Companies

Why Capital Efficiency Is Key To Building A Successful Business

Other Sources:

How Startups Should Think About Capital Efficiency in this COVID period

The Return of Capital Efficiency

On Startup Capital Efficiency | Hacker News

“Venture Capital Efficiency” and fundraising success

What Is Capital Efficiency And Why Is It Important?

An Unintended Consequence of Capital-Efficient Companies